Table of Contents

Reasons you should postpone retirement

I recently read Suze Orman’s book, The Ultimate Retirement Guide For 50+: Winning Strategies To Make Your Money Last A Lifetime.

In the book, she repeatedly recommends delaying retirement until *at least* 70 years old. Her main reason is so that you don’t run out of money because statistics show you are likely to live into your 90s.

So, I poked around the interwebs to see what others were saying.

One Facebook group I belong to basically agreed that Suze should go jump in a lake – the majority said they’re going to start enjoying retirement as soon as possible!

So – should you postpone retirement?

If you’re in your 50s and you’ve been procrastinating with your retirement savings, then stretching your working years until you’re 70 (or beyond) may be a lifesaver.

Personally, I don’t mind the idea of working until I’m 70, or even older. I think if you can swing it, there are many good and valid benefits to staying employed.

Here are 20 smart reasons to postpone retirement, at least until you’re 70.

Need some help planning your retirement? Get this FREE mini-workbook and start creating the retirement you want!

#1 You enjoy working

If you’re someone that likes to work and gets great fulfillment from putting in the energy and the hours, then staying employed is probably a good option for you.

Of course, you don’t have to continue the career you’ve had. You can try something new, as long as you continue to get some kind of contentment from it.

#2 You’re in good health

The condition of your physical and mental health will have a great bearing on whether or not you can continue to work.

But, if you’re blessed with good health, then continuing to work is a strong possibility.

#3 You want to maintain (or increase) your standard of living

A common retirement guideline is that you should try to replace 70-80% of your pre-retirement income with savings, investments and social security.

But, if you’d rather continue generating 100% (or even more), then working into your 70s might be necessary.

#4 You want to maximize the effects of compound interest

The longer you can let your savings sit in an interest-bearing account, and allow your investments to keep growing, the more you’ll benefit from the magic of compound interest.

If you can keep bringing in a paycheck to cover your expenses, you’ll continue to maximize the exponential effect on your savings and investments.

#5 You want to maximize your Social Security benefits

Your Social Security checks will be bigger the longer you wait to receive them, up until you reach 70.

In fact, for every year you delay taking the benefit past full retirement age, you’ll receive an 8% increase in your benefit, until age 70.

So, if you’re in good health and you have a good chance of living into your 80s or 90s, waiting is the best choice. Especially if you have a spouse who will rely on survivor benefits.

However, you may need to bridge the financial gap with a few extra years of employment to cover your expenses.

#6 You’ll still get employee benefits

Many people think that once they hit 65 and are eligible for Medicare, they’ll be covered for free.

But Medicare does not cover everything, and you could still experience major out-of-pocket expenses.

If you could fill those coverage gaps with an employee healthcare plan, you could save thousands of dollars a year in medical expenses.

#7 You could delay or slow down savings depletion

The longer you can generate income with a paycheck, the longer your savings will last.

This is especially important if you’re in your 50s and your retirement savings is lacking.

Working until you’re 70 or beyond would mean delaying the use of savings and decreasing the number of years you’ll need to rely on it.

#8 You still have debt

The strong recommendation with retirement planning is to be out of debt by the time you stop working.

If you’re still paying down your credit cards, student loans, or yes – even your mortgage – then extending your working years will help you eliminate your debt before you retire.

(Just don’t add any more to it!)

Create a debt payoff plan now so you’ll be debt-free in your retirement years. This is one of the smartest reasons to postpone retirement.

Dave Ramsey: Advice for catching up with retirement savings

#9 You’ll get a bigger pension

If you’re fortunate enough to have a pension, you might get a bigger payout the longer you work.

Some pension plans are calculated based on your average earnings over the last few years of employment.

So, if your income continues to increase up until you retire, your benefit could also keep going up the longer you work.

#10 You won’t get any pension

These days, most companies have stopped offering a retirement pension in favor of an employer-sponsored retirement account, like a 401(k).

This puts the responsibility of saving for retirement squarely on the shoulders of the employee.

So, even if you’ve been with the same company for decades, you may not receive any retirement benefits if you’ve failed to put any money into a retirement plan.

If this is the situation you’re in, you may need to continue working into your 70s to catch up on your savings.

#11 You want to enjoy an encore career

Considering the possibility of working into your 70s doesn’t mean you have to stay in the same career.

Many people in their 60s and 70s discover a whole new level of job satisfaction by pursuing work that they’re passionate about.

This is one of the most motivational reasons to postpone retirement!

Think about how you could turn a hobby into an income, or give back to your community with your years of experience.

#12 You want to have the camaraderie of a workplace

You may dream now about having long, relaxing days at home as you sit in your La-Z-Boy and do crossword puzzles.

But after some time, you may start to feel out of touch and a bit lonely.

Continuing to work in a place where you’re part of a team or larger staff could help you feel connected to others, build friendships, and feel like you’re part of a community.

#13 You want to reduce the chances of depression and poor health

Staying active, socially connected, and engaged with life can mean better overall health and fewer medical issues.

Having even a part-time job could provide more meaning and routine, especially if your work is driven by a newfound passion.

You could actually even add years to your life, according to a study that found delaying retirement by one year lowered the chance of death by 11%.

#14 You want to coordinate with a younger spouse

Many couples like to retire within 2-3 years of each other so they can enjoy more time together.

But, if your spouse or partner is several years younger than you, he may not be ready to retire when you are.

If he wants to continue his career after you turn 65, you may want to delay retiring for a few years so your retirement dates can be closer together.

#15 You started your career later in life

Maybe you were a stay at home for 25 years, and then decided to go back to college and start a career when you turned 50.

You may not be ready to hang up your hat at 65 because you feel you have more to offer.

Extending your career into your 70s could give you more time to fulfill the goals you have in your profession.

#16 You live far from your family

For many moms (like myself), it’s our dream to one day be surrounded by our grandkids, and enjoy friendship with our adult children.

But, life rarely goes as planned.

If your kids have moved away and you only get to see them a few times a year, continuing to work could be a great way to stay busy and have extra money for all those plane tickets.

#17 You want financial stability

When you retire, your guaranteed income is drastically reduced.

You’ll get your dependable Social Security check and possibly a pension benefit every month, but what you can pull from savings and investments is not guaranteed.

If this gives you feelings of anxiety or worry, you may want to continue generating a guaranteed income with a job just for the peace of mind.

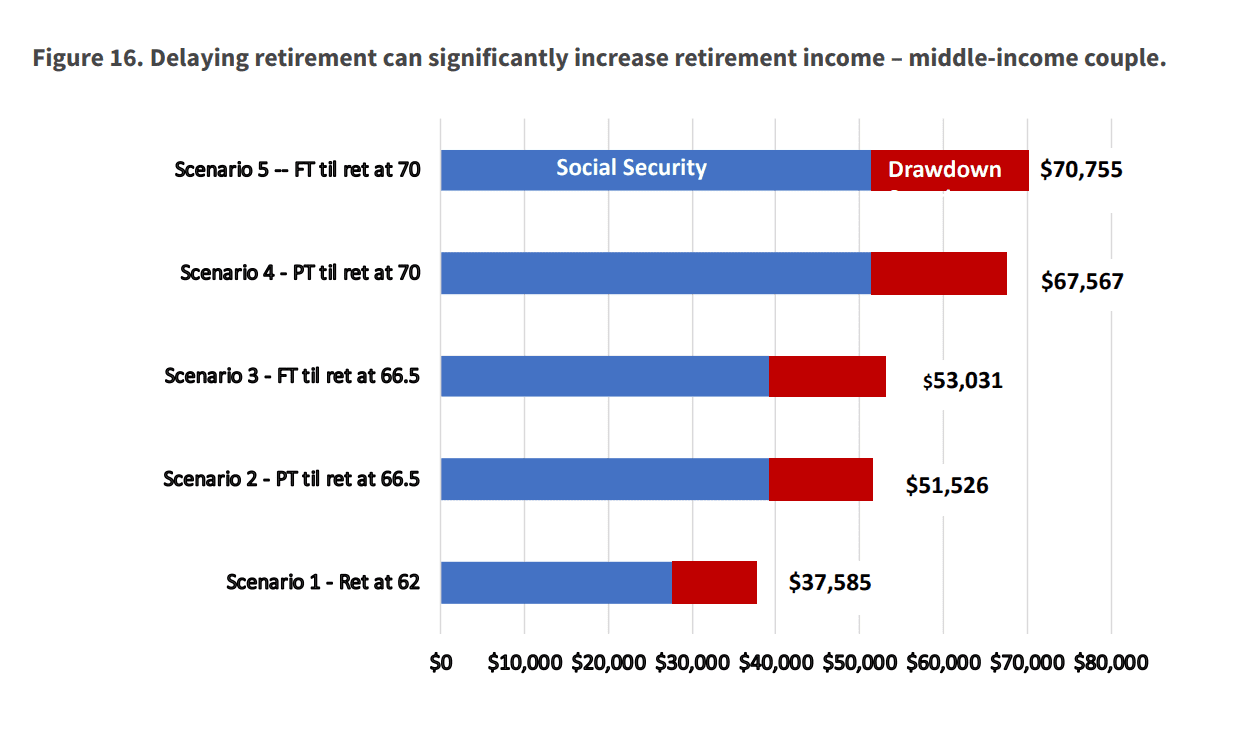

Stanford researchers report postponing retirement until 70 can significantly increase retirement income:

From CNBC.com

#18 You want enough to cover the extras

The closer you get to retirement, you may realize your savings will only cover the basics of living, like food, gas, and property taxes.

If you want to keep up with inflation and also cover extras like long-term care, gap insurance, and rising medical costs, then delaying retirement until your 70s could be a wise move.

#19 You may live until your 90s

Many people want to start retirement as soon as possible because they don’t know how much time they have left.

They want to enjoy the last few years of life before they die.

But, these days, the potential of living longer – even into your 90s – has increased greatly thanks to the improvements in modern medicine.

So, don’t just consider the possibility of only having 10-15 years in retirement, because you might have double that!

Working until you’re 70 can help ensure you remain financially stable and still leave you with decades to enjoy retirement.

#20 You can’t afford to retire yet

This is probably the most important and beneficial reason to continue working into your 70s.

If you’re a late saver and didn’t get serious about retirement planning until your 50s, you may have to come to terms with the fact that you just won’t have enough to support yourself without keeping a job.

The more years you can generate a paycheck without touching your savings, the longer those retirement accounts will have to grow, and the fewer years they’ll need to support you.

Don’t forget to grab your FREE Retirement Planning mini-workbook! Make a plan to turn your dream retirement into a reality.

In summary: Reasons to postpone retirement

The safest plan is to overplan. The idea of working into your 70s may not interest you in the slightest, but it’s still a smart move to prepare for the possibility.

You could even use the idea of delaying retirement as motivation to take the best care of your health today. If you commit to a healthy diet, exercise, and getting your preventative checkups, your options for working longer are more likely to remain open.

Perhaps the thought of starting your own business or an encore career makes the possibility of working longer more appealing.

If so, your 50s is a great time to get that ball rolling. You can hone your skills, take some classes, create a website, build an audience, and get the word out.

It can take years to get a business high enough off the ground to create a livable income. If you start now, then even in your minimal spare time you can build something that could eventually become a fulfilling and lucrative second career in your older years.

There are many smart reasons to postpone retirement – even for just 5 years. Your decision will depend on several factors, such as your health and financial situation.

If you do what you can today to keep your options open later, you’ll be in a better position to make your money last a lifetime – even if you’re still around at 100!

Other posts you may enjoy:

- The Late Starter’s Essential Roadmap For Retirement

- 7 Steps To Catch Up On Retirement Savings

- 12 Effective Tips For Financial Planning In Your 50s

- The 401(k) and the IRA: Which One Is Better?

- Get Your RISE Score: 5 Steps To Determine Retirement Readiness

- Pros and Cons of a Health Savings Account

- Should You Use The 4% Rule In Retirement?

- 50 Steps To Wealth Creation and Retiring A Millionaire

- 50 Good Money Habits To Help You Save More

- 9 Smart Reasons To Check Your Credit Report Regularly

Want to remember this post for later? Pin this post to your favorite Pinterest board!