Table of Contents

What happens if you don’t have a living trust?

Most people think that having a trust is just for the wealthy. But really, a trust is just a legal entity that arranges your assets in a way that benefits you while you’re alive, and then your heirs after you die.

A living revocable trust is a written document you create that “holds” ownership over your assets when you’re still living, then transfers those assets upon your death.

So, whether you have $100,000 or $5 million in assets, a living revocable trust can be an important part of setting up your own estate plan.

But, what happens if you don’t have a living trust? Is it really that important?

Many people don’t get a trust because they think they don’t need one or it’s not worth the cost. You’ll have to decide for yourself, and consider the effort and financial sacrifice that’s required to set one up.

Here are 6 reasons why you might think you don’t really need a living revocable trust – and the consequences for not having one.

Want to know the differences between a simple will and living trust? Download this free resource:

#1 You want to leave your loved ones the financial burden of probate court

Not having a living revocable trust in place when you die means your family will need to go through the probate process in order to distribute your estate. This is true whether you have a will or not.

Probate is the legal process the court uses to ensure your debts are paid and your assets are distributed according to your will once you die. And, if you don’t have a legal will, the court will distribute your assets according to the laws of your state.

Just like any other legal measure, probate court is expensive and complicated.

This means your loved ones will likely need to hire a probate lawyer, resulting in high legal fees (easily in the thousands).

These fees must be paid before your heirs can receive any assets you’ve left them. Things get even more complicated if you happen to own property in other states. Each state has its own probate laws, and your heirs could potentially have to endure multiple probates.

The probate process is also lengthy – typically nine to twenty-four months, and sometimes longer. Your assets can be frozen by the court during this time, which means your family would need to rely on other resources until they’re released for distribution.

If you want to leave this financial burden on your family after you die, then you may not want a living revocable trust.

#2 You want your heirs to delay receiving their inheritance

Because the absence of a living revocable trust results in going through probate, there will be a delay in your heirs receiving an inheritance.

Whatever instructions you left behind for your loved ones must be processed through the court system and declared valid by a judge. Depending on the complexity and value of your estate, this could potentially take years!

Your family would essentially be at the mercy of the probate court system, which determines how long the process will take and how much it will cost.

If you don’t care how long it takes for your loved ones to receive what you have granted them, then a living revocable trust may not be for you.

#3 You don’t care about your privacy

One of the big differences between a trust and a will is that a living trust is not made public upon your death, while a will is a public record and therefore all transactions would be made public as well.

A living revocable trust does not require the probate process to distribute your assets, so everything remains private.

But, if you only have a will, your assets and debts become public information in the probate process. This can lead to long-lost cousins stepping forward to claim their stake and contest your will. Even unethical lawyers can take advantage of the situation and cause additional trouble for your family.

If privacy is not a priority for you, this is another good reason to not create a trust.

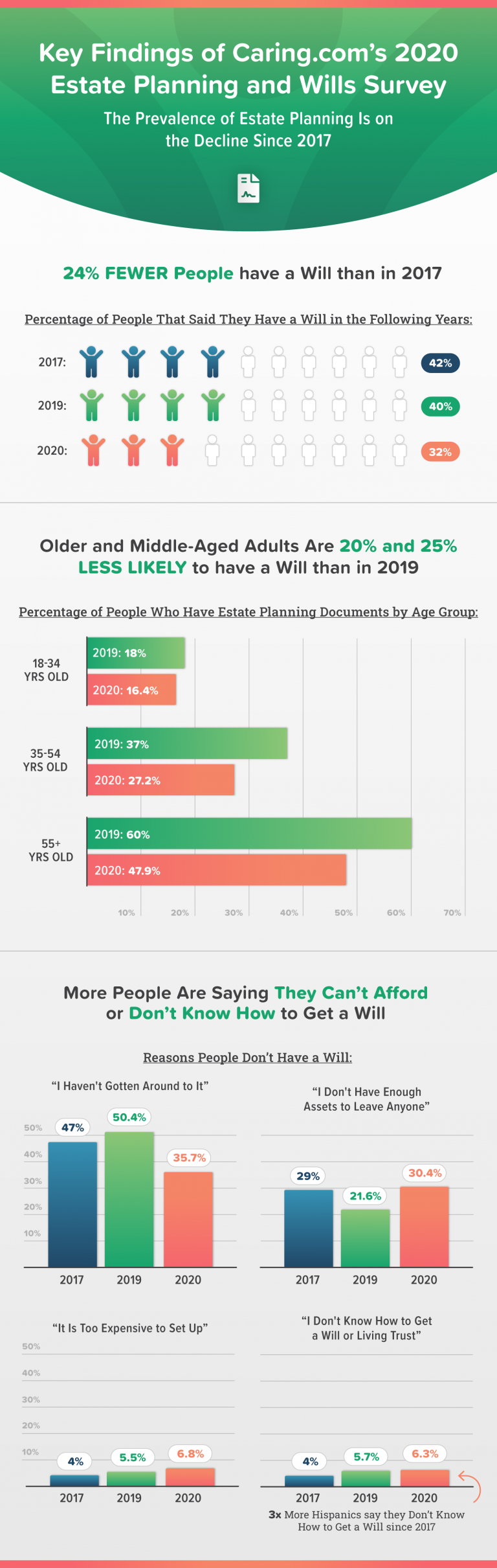

Caring.com’s 2020 Estate Planning &Wills Survey

From Caring.com

#4 You want a judge to make decisions for you if you become incapacitated

When you create a living revocable trust, you assume the title of “trustee“. This means you are the owner and manager of the trust, and because it’s “living”, you can make changes to it up until your death.

In addition, you also appoint a “successor trustee“. This person will manage your trust on your behalf in the event you become mentally or physically unable for whatever reason. This is typically someone you know and trust, and who has your best interest in mind.

But, a simple will does not take effect until death. So, if you became incapacitated and were unable to communicate your wishes while you were still alive, your family would need to go to probate court to have you declared incompetent.

This would create an additional financial expense, as well as adding difficulty to an already challenging situation. This is what happens if you don’t have a living trust.

The court would then get involved in the management of your estate, taking control of your assets and making financial decisions for you. A judge may appoint a conservator (which is like a guardian) that may or may not be a family member. The decision is up to the court.

If you don’t have a preference for how your estate is managed if you became unable to do it yourself, then it might not be worth it to create a trust for your estate.

#5 You don’t mind your loved ones becoming homeless

Wow, this is harsh!

But, there are certain circumstance when a trust could absolutely protect you from losing your home.

Perhaps you own a home that has very little equity, and you want to leave it to your devoted son who lives with you and has taken care of you in your old age. Because he is your full-time caregiver, he’s not employed somewhere else or generating his own income.

You make your wishes known in your will, thinking you will be taking care of him even after your death.

After you die, your will goes through the probate process. This could take months or even years. The lawyer, executor, and probate fees are more than your son can pay for. So, the judge orders the sale of the home to pay the legal fees.

Your son loses the home and has to find another place to live.

With a living revocable trust, you could have put your home in the trust, therefore bypassing probate court.

And your son would have received ownership within weeks.

But, if guaranteeing the security of your home to your chosen heirs is not a priority, then a trust may not be something you should pursue.

It’s up to you!

#6 You know you’re going to die soon

There are 3 phases that a living revocable trust is active and in effect: while you’re alive and healthy, while you’re alive but incapacitated, and after you die.

A simple will, on the other hand, only goes into effect after you die.

So, if you plan on dying soon, then you may not want to go through the trouble of setting up a living revocable trust. Especially if the other reasons on this list are valid for you as well.

Learn the major differences between a simple will and living trust with this free PDF:

Consider carefully what happens if you don’t have a living trust

Of course, this post pokes a bit of fun at the decision to *not* have a living revocable trust as part of your estate plan. If you’re like most people, probably none of the reasons listed above pertain to you and how you want to leave your legacy.

Of course you care about what happens to your loved ones after you die, and you want to minimize any burdens they would have to endure once you’re gone.

A living revocable trust can save your family and heirs a lot of expense and hassle, as well as protect you and your assets while you’re still alive.

There are a lot of good reasons to have one as part of your estate plan.

However, there are still valid reasons it may not be the best choice for you.

Maybe you are single with no children, and your estate is simple and not worth a whole lot. Maybe you just don’t care what happens to your stuff after you’re gone.

But, if you do, the best thing is to meet with an estate planning attorney and have a conversation about how a trust and a will provide protection for you and your family.

Then, weigh the options carefully, make a decision, and take action.

Planning for the future today is one of the most loving and generous acts you can do for those you love. Don’t leave it to chance, and don’t wait until it’s too late.

Other posts you may enjoy:

- Pros and Cons of a Health Savings Account

- The 401(k) and the IRA: Which One Is Better?

- The Late Starter’s Essential Roadmap For Retirement

- Ultimate Estate Planning Checklist & Guide

- Get Your RISE Score: 5 Steps To Determine Retirement Readiness

- Should You Use The 4% Rule In Retirement?

- 7 Steps To Catch Up On Retirement Savings

- 12 Effective Tips For Financial Planning In Your 50s

- 50 Good Money Habits To Help You Save More

Want to save this post for later? Pin it to your favorite Pinterest board!

What Happens If You Don’t Have A Living Trust? (6 Honest Reasons You Don’t Need One)